How To Turn 10K Into 100K (15 Best Ways)

This article will show you exactly how to turn 10k into 100k: Embarking on the journey from 10k to 100k is like setting sail on a financial adventure, navigating the unpredictable seas of investments and strategic financial moves.

Whether you’re a seasoned investor seeking to multiply your capital or a newcomer eager to make your money work for you, this guide is your treasure map to the 15 best ways to turn that initial 10k into a thriving 100k.

In a world where financial opportunities are as vast as the ocean, it’s crucial to have a compass and a reliable strategy. From traditional methods that have withstood the test of time to modern, innovative approaches, this comprehensive guide will explore the diverse avenues available to you. Brace yourself for a journey filled with learning, calculated risks, and the potential for substantial returns.

The road to financial growth is not a straight path; it’s a series of twists, turns, and strategic decisions. As we explore each of the 15 ways, keep in mind that every investor’s journey is unique.

What works for one may not work for another, and the key is to tailor these strategies to fit your financial goals, risk tolerance, and time horizon.

1. Start Blogging

In the vast landscape of the digital age, where words wield immense power, blogging stands as a beacon of self-expression, information dissemination, and community building. It’s a medium that has transformed the way we share ideas, stories, and expertise, connecting individuals across the globe through the click of a button.

Blogging, once a personal online diary, has evolved into a powerful platform that spans niches ranging from lifestyle and travel to business and technology. At its core, blogging is more than just a string of words on a screen; it’s a dynamic art form that allows individuals to carve their digital footprint, leaving an impact on the virtual world.

This guide is your passport into the captivating universe of blogging, whether you’re a seasoned wordsmith or someone contemplating their inaugural post. We’ll unravel the layers of what makes a blog successful, exploring the nuances of content creation, audience engagement, and the ever-evolving landscape of the blogosphere.

From the early days of blogging as a personal outlet to its current status as a viable career path, the journey of blogging is as diverse as the content it houses. Whether you aspire to share your passion, build a community, or leverage it as a business tool, blogging offers a versatile platform for those willing to embark on the adventure of digital storytelling.

So, grab your metaphorical pen and paper, or in this case, your keyboard and screen, as we embark on a journey into the art, science, and joy of blogging. Are you ready to unleash your creativity and join the ranks of digital wordsmiths? Let’s dive into the world of blogging and discover the infinite possibilities that await!

Also Read This: How To Start A Blog

2. Start an Online Business

In the vast and ever-expanding landscape of the digital age, the notion of starting an online business has become synonymous with entrepreneurial freedom and limitless potential. The internet has not only connected people across the globe but has also opened doors for aspiring business owners to turn their dreams into reality with just a few clicks.

The allure of starting an online business lies in its accessibility and the democratization of commerce. Whether you’re a seasoned entrepreneur seeking to expand your reach or someone with a passion itching to be transformed into a livelihood, the online realm offers a fertile ground for innovation, creativity, and, of course, profit.

This guide is your gateway to the dynamic world of online entrepreneurship, a roadmap for those ready to navigate the challenges and seize the opportunities that come with building a digital empire. From e-commerce ventures and digital services to content creation and affiliate marketing, the online business sphere is a vast ecosystem waiting to be explored.

As we embark on this journey together, we’ll unravel the intricacies of crafting a successful online business—from defining your niche and building a digital presence to understanding the nuances of online marketing and customer engagement. The possibilities are as vast as the internet itself, and with the right strategy, dedication, and a sprinkle of innovation, you can turn your online business venture into a thriving success.

So, whether you’re fueled by a unique product idea, a service that addresses a specific need, or a burning entrepreneurial spirit, fasten your seatbelt as we dive into the world of possibilities. Are you ready to transform your aspirations into a digital reality? Let’s embark on the adventure of starting an online business!

- Identify Your Niche: Define your target market and niche. What unique value can your business bring to the online community?

- Build a Strong Online Presence: Establish a compelling website and leverage social media platforms to connect with your audience. Your online presence is your storefront in the digital landscape.

- E-Commerce Strategies: If you’re selling products, understand e-commerce platforms, payment gateways, and the logistics involved in delivering your goods.

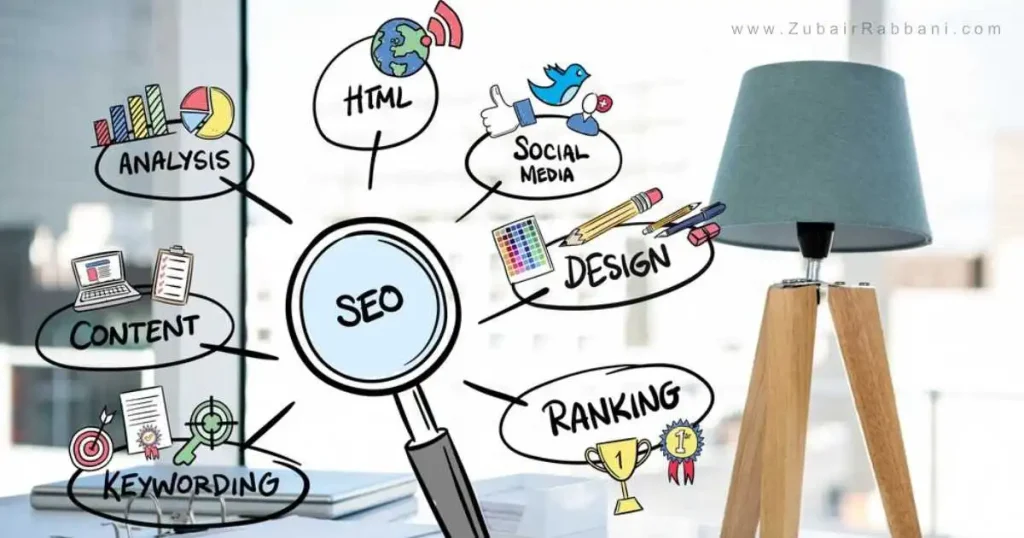

- Digital Marketing: Explore the vast landscape of digital marketing, including SEO, social media marketing, and email campaigns, to enhance your business’s visibility.

- Customer Engagement: Foster a community around your brand. Engage with your audience through meaningful content, customer support, and interactive features.

Starting an online business is not just about creating a product or service; it’s about crafting a digital experience that resonates with your audience. With the right mindset and strategies, you can turn your online business venture into a fulfilling and successful endeavor. Are you ready to embark on this digital odyssey? Let’s explore the steps to transform your entrepreneurial dreams into reality!

3. Write an Email Newsletter

In the fast-paced realm of digital communication, where information floods our screens in an instant, the email newsletter stands out as a beacon of thoughtful connection. It’s not just an electronic message; it’s a curated piece of communication that has the power to engage, inform, and build lasting relationships.

The act of crafting an email newsletter is akin to composing a letter to a friend, but on a broader scale. It’s a direct line to your audience, a virtual dialogue that transcends the noise of social media and delivers valuable content right to the inbox. Whether you’re a content creator, business owner, or enthusiast with a story to share, the email newsletter provides a personalized space for your voice to resonate.

This guide is your entryway into the world of email newsletters—a realm where words become bridges, connecting you to your readers in a meaningful way. From understanding your audience and designing visually appealing layouts to mastering the art of compelling subject lines and valuable content, we’ll unravel the elements that transform a mere message into a captivating newsletter.

As we embark on this journey together, keep in mind that an email newsletter is not just about promotion; it’s about building a community, fostering trust, and offering something of value to those who willingly invite you into their digital space. So, whether you’re a seasoned writer or someone contemplating your first newsletter, join me as we navigate the intricacies of crafting emails that leave a lasting impression.

4. Invest in Real Estate

Welcome to the world of real estate, where opportunities abound and investments thrive. Investing in real estate is more than just a financial decision; it’s a journey towards building wealth, securing your future, and embracing the tangible nature of property ownership. In this dynamic realm, the potential for growth is as expansive as the properties themselves. Let’s explore the compelling reasons why diving into real estate might be your key to financial success:

- Stability and Tangibility: Real estate stands as a tangible asset, providing a sense of security and stability in an ever-changing financial landscape. Unlike stocks or bonds, you can see and touch your investment, creating a connection that goes beyond mere numbers on a screen.

- Diversification: A well-rounded investment portfolio is the key to long-term success. Real estate offers diversification, acting as a resilient counterpart to traditional investment avenues. As markets fluctuate, property values often remain steadfast, offering a reliable anchor for your overall financial strategy.

- Income Generation: Whether through rental income or property appreciation, real estate provides a consistent source of cash flow. Strategic property selection and management can turn your investment into a reliable income stream, offering financial freedom and flexibility.

- Tax Advantages: The world of real estate comes with a range of tax benefits. From mortgage interest deductions to depreciation allowances, savvy investors can leverage these advantages to optimize their tax liabilities and enhance overall returns.

- Long-Term Appreciation: Real estate has a history of appreciating over time. While short-term market fluctuations occur, the value of well-chosen properties tends to increase in the long run. This potential for appreciation can significantly contribute to your overall wealth accumulation.

As we embark on this exploration of real estate investment, buckle up for a journey where calculated risks meet lucrative rewards. Whether you’re a seasoned investor or a newcomer to the world of property, the realm of real estate offers a myriad of possibilities for those willing to seize them. Let’s unlock the doors to financial prosperity together.

5. Flip Websites

Step into the realm of digital entrepreneurship, where innovation meets investment—the art of flipping websites. In an era driven by online presence, websites have become virtual real estate, ripe with potential for those with the vision to transform and the acumen to profit. Website flipping is not just a transaction; it’s a dynamic process of acquiring, enhancing, and selling digital assets for maximum returns. Here’s a glimpse into the captivating world of flipping websites and why it might be the venture you’ve been searching for:

- Digital Real Estate: Websites are the storefronts of the digital landscape, and just like physical properties, they can be bought, renovated, and sold for a profit. The digital real estate market offers a playground for creative minds to breathe new life into existing web entities and turn them into lucrative ventures.

- Low Entry Barriers: Unlike traditional businesses that may require significant capital and time to establish, website flipping often boasts low entry barriers. Entrepreneurs with a keen eye for opportunities can leverage their skills to identify undervalued websites, revamp them, and swiftly enter the market.

- Rapid Returns: The pace of the online world is unparalleled, and website flipping aligns with this speed. Compared to traditional investments, the turnaround time for website flipping can be remarkably quick. Savvy investors can capitalize on trends, optimize websites, and flip them for rapid returns.

- Skill Development: Engaging in website flipping isn’t just about buying and selling; it’s a journey of skill development. From SEO optimization to content creation, each flip offers a chance to enhance your digital skill set. This continuous learning process not only increases the value of your flips but also positions you as a seasoned player in the online marketplace.

- Marketplace Opportunities: With dedicated online platforms and marketplaces catering specifically to website flipping, the process has never been more accessible. These platforms connect buyers and sellers, providing a streamlined and secure environment for transactions. Whether you’re looking to acquire a promising project or cash in on your digital creation, these marketplaces offer a bustling marketplace for website enthusiasts.

Embark on a digital adventure where every website is a canvas, and every flip is a stroke of innovation. Website flipping is not just a business; it’s a dynamic journey that invites you to explore the limitless possibilities of the online world. Join the ranks of digital entrepreneurs who turn virtual properties into real profits, one flip at a time.

6. Start a YouTube Channel

Welcome to the boundless universe of digital storytelling—where ideas come to life, creativity knows no bounds, and communities thrive. In the era of online connectivity, starting a YouTube channel isn’t just a venture; it’s an invitation to share your passions, connect with audiences worldwide, and carve your unique space in the vast landscape of online content. Here’s a glimpse into the exciting world of launching your very own YouTube channel and the myriad possibilities that await:

- Creative Expression: A YouTube channel is your canvas, and the content you create is your masterpiece. Whether you’re passionate about gaming, beauty, education, or comedy, YouTube offers an unparalleled platform for creative expression. Unleash your imagination, share your expertise, or simply showcase your unique perspective to a global audience hungry for fresh, diverse content.

- Global Reach: The power of YouTube lies in its global accessibility. With over two billion logged-in monthly users, your content has the potential to reach audiences in every corner of the world. Connect with like-minded individuals, bridge cultural gaps, and create a community that resonates with your vision.

- Monetization Opportunities: Beyond the joy of creating, YouTube presents opportunities for financial growth. Once you’ve built a dedicated audience, you can explore various monetization channels, from ad revenue and sponsorships to merchandise sales. Turning your passion into a sustainable income stream is not just a dream—it’s a tangible possibility.

- Learning and Growth: Starting a YouTube channel isn’t just about sharing your knowledge; it’s also a journey of continuous learning and personal growth. Hone your video editing skills, master the art of storytelling, and navigate the ever-evolving landscape of online content creation. Each video is a chance to refine your craft and connect with an audience eager to learn and be entertained.

- Community Building: The heart of YouTube beats in its communities. Engage with your audience through comments, live chats, and social media. Create a space where individuals with shared interests come together, forming a supportive and vibrant community that fuels your creative endeavors.

As you embark on this exciting venture, remember: your YouTube channel is more than just a platform—it’s an extension of you. So, whether you’re an aspiring creator or a seasoned storyteller, seize the opportunity to share your voice, inspire others, and shape the digital landscape one video at a time. The adventure begins now.

7. Invest in Dividend Stocks and ETFs

Welcome to the realm of financial growth and passive income—where investments not only hold the promise of appreciation but also deliver consistent returns. Investing in dividend stocks and exchange-traded funds (ETFs) is a strategic journey toward building a portfolio that works for you, earning even while you sleep. In this landscape of financial opportunities, let’s explore why diving into dividend-paying assets might be your key to long-term prosperity:

- Steady Income Stream: Dividend stocks and ETFs offer a reliable and consistent income stream. Unlike investments that rely solely on capital appreciation, companies that pay dividends distribute a portion of their profits to shareholders regularly. This creates a steady cash flow, providing financial stability and the potential for reinvestment.

- Historical Resilience: Dividend-paying stocks have a history of weathering market volatility with resilience. Companies that prioritize regular dividend payouts often demonstrate financial health and stability. This characteristic not only makes them attractive during uncertain market conditions but also positions them as long-term anchors in a well-balanced portfolio.

- Compounding Growth: Reinvesting dividends can be a powerful wealth-building strategy. The compounding effect allows your investment to grow exponentially over time. As you reinvest dividends, you not only benefit from the initial yield but also from the subsequent growth of the reinvested income.

- Diversification: Investing in dividend stocks and ETFs provides an avenue for diversification within your portfolio. With exposure to various sectors and industries, you can mitigate risk and ensure that your investments aren’t overly reliant on the performance of a single company or sector.

- Tax Advantages: In many jurisdictions, dividends are taxed at a lower rate than other forms of income. This tax advantage enhances the overall return on your investment, allowing you to keep more of your earnings and further contributing to the appeal of dividend-focused strategies.

As we navigate the world of investing, consider dividend stocks and ETFs not just as assets but as partners in your financial journey. These investments offer a unique combination of stability, income, and growth potential—a trifecta that can pave the way to financial freedom. Join the ranks of investors who embrace the power of dividends and witness your wealth grow, one payout at a time.

8. Invest in Cryptocurrency

Welcome to the thrilling frontier of finance, where digital innovation meets the age-old pursuit of wealth accumulation—welcome to the world of cryptocurrency investment. In an era defined by decentralized currencies and blockchain technology, investing in cryptocurrencies isn’t just a financial choice; it’s an exploration of the future of money and a gateway to the potential for exponential returns. Let’s embark on a journey into the dynamic realm of cryptocurrency investment and uncover why it might be the key to reshaping your financial landscape:

- Digital Revolution: Cryptocurrencies represent a paradigm shift in the way we perceive and exchange value. Born from the digital revolution, these decentralized digital assets offer a departure from traditional financial systems, providing individuals with unprecedented control over their wealth and transactions.

- Potential for High Returns: The cryptocurrency market is known for its volatility, and with volatility comes the potential for high returns. As digital currencies experience price fluctuations, strategic investors can capitalize on market movements, turning them into opportunities for substantial gains.

- Diversification: In the quest for a well-rounded investment portfolio, cryptocurrencies offer a unique avenue for diversification. Unlike traditional assets, cryptocurrencies operate independently of traditional financial markets, providing a hedge against economic uncertainties and potential correlation risks.

- Innovation and Technology: Investing in cryptocurrencies isn’t just about financial gains; it’s an endorsement of cutting-edge technology. Blockchain, the underlying technology of most cryptocurrencies, has the potential to revolutionize industries beyond finance, offering transparency, security, and efficiency in various sectors.

- Global Accessibility: Cryptocurrencies transcend geographical boundaries, offering a level playing field for investors worldwide. With just an internet connection, individuals can participate in the cryptocurrency market, democratizing access to financial opportunities and challenging the traditional barriers of entry.

As we navigate the uncharted waters of cryptocurrency investment, it’s essential to approach this dynamic landscape with a blend of curiosity, strategic thinking, and risk awareness. Whether you’re a seasoned investor or a newcomer to the world of digital assets, investing in cryptocurrencies invites you to be part of a transformative journey where traditional norms give way to a new era of financial possibilities. Buckle up for a ride where the digital meets the tangible, and the future of finance unfolds before your eyes.

9. Start a Service-Based Business

Embarking on the journey of starting a service-based business is a thrilling venture that opens doors to endless possibilities. In a world where expertise and skills are highly valued, offering services can be a rewarding avenue for both personal fulfillment and financial success. Whether you’re a seasoned professional looking to break free from the traditional 9-to-5 grind or a passionate individual eager to turn your skills into a thriving enterprise, the service industry beckons with promise.

Key Points to Consider:

- Identify Your Niche: Before diving in, pinpoint your area of expertise. What unique skills or knowledge do you possess that can fulfill a demand in the market? Understanding your niche is the first step in creating a service that stands out.

- Market Research: A successful service-based business starts with a deep understanding of the market. Who are your competitors? What are the current trends? Conduct thorough research to identify opportunities and potential challenges.

- Build a Strong Brand: Your brand is more than just a logo—it’s the identity of your business. Create a brand that reflects your values, resonates with your target audience, and sets you apart from the competition.

- Craft Compelling Services: Clearly define and articulate the services you offer. What problems do you solve for your clients? How does your expertise add value to their lives or businesses? Craft compelling service packages that showcase your unique selling propositions.

- Set Clear Goals: Establishing clear and achievable goals is crucial for the success of any business. Whether it’s financial targets, customer acquisition milestones, or personal development objectives, having a roadmap will guide your efforts and measure your progress.

- Embrace Technology: Leverage technology to streamline your processes and enhance customer experiences. From digital marketing strategies to project management tools, staying tech-savvy can give your service-based business a competitive edge.

- Build a Strong Online Presence: In today’s digital age, an online presence is non-negotiable. Develop a professional website, engage in social media marketing, and harness the power of online platforms to reach a wider audience.

Embarking on the journey of a service-based business is an exciting endeavor that requires a blend of passion, strategy, and resilience. As you navigate the path ahead, keep these key points in mind to build a foundation for lasting success.

10. Flip Items for Money

Welcome to the dynamic realm of flipping items for money—a craft that transforms ordinary transactions into lucrative opportunities. Whether you’re seeking a side hustle to boost your income or dreaming of a full-fledged entrepreneurial venture, the world of flipping invites you to uncover hidden treasures and turn them into valuable assets.

Key Points to Consider:

- Treasure in the Ordinary: The essence of flipping lies in recognizing the value in everyday items. From vintage finds at thrift stores to overlooked gems in garage sales, there’s a world of untapped potential waiting for those with a keen eye.

- Research and Knowledge: The success of a savvy flipper is rooted in research. Stay informed about market trends, sought-after brands, and emerging niches. Knowledge is your currency, guiding you toward the most profitable opportunities.

- Start Small, Scale Big: Begin your flipping journey by starting small. Experiment with items that interest you or align with your expertise. As you gain confidence and experience, scale your efforts to explore larger markets and higher-value items.

- Build a Network: Networking is a powerful tool in the world of flipping. Connect with fellow flippers, attend auctions, and engage in online communities. Building a network opens doors to valuable insights, potential partnerships, and collaborative opportunities.

- Embrace Online Platforms: The digital era has transformed the landscape of flipping. Leverage online platforms, such as e-commerce websites and auction sites, to showcase your finds to a global audience. The internet is your storefront, connecting you with buyers from around the world.

- Creativity and Upcycling: Unleash your creativity by exploring upcycling opportunities. Transforming and repurposing items not only adds value but also enhances their appeal. This creative touch can set your flips apart in a crowded market.

- Financial Strategy: A successful flipper is not just a treasure hunter but also a shrewd financial strategist. Set realistic budgeting goals, calculate potential profits, and track your expenses. A sound financial strategy ensures that your flipping endeavors are not just exciting but also financially rewarding.

As you step into the world of flipping items for money, remember that each transaction is an opportunity for discovery and profit. With a curious spirit, a discerning eye, and a strategic mindset, you’ll unlock the potential to turn the ordinary into the extraordinary.

11. Invest in Initial Public Offerings (IPOs)

Embarking on an investment journey is akin to setting sail into uncharted waters, seeking opportunities that promise growth, innovation, and financial rewards. One such frontier that beckons seasoned and aspiring investors alike is the realm of Initial Public Offerings (IPOs). An IPO marks the transition of a private company into a publicly traded entity, offering investors a chance to become early stakeholders in a company poised for expansion.

Key Points to Consider:

- Definition of IPO: An IPO represents a company’s first sale of stock to the public. It is a monumental step in a company’s lifecycle, allowing it to raise capital from a diverse pool of investors, and in return, investors gain access to a slice of the company’s ownership.

- Early Entry into Promising Ventures: Investing in IPOs provides an opportunity to be an early participant in the growth story of a company. As the company goes public, investors can capitalize on potential market enthusiasm, aiming to benefit from the upward trajectory of the stock value.

- Conduct Thorough Research: In the world of IPOs, knowledge is power. Prior to investing, conduct extensive research on the company’s financial health, business model, competitive landscape, and growth prospects. A well-informed decision is your best defense against market volatility.

- Understand the Risks: While IPOs present exciting prospects, they also come with inherent risks. Newly public companies may experience heightened volatility, and their stock prices can fluctuate significantly in the initial period. Understanding and accepting these risks is crucial for prudent investment.

- Evaluate the Company’s Long-Term Potential: Look beyond the initial hype. Assess the company’s long-term potential for sustainable growth. Consider factors such as market demand, management competence, and the company’s competitive advantage in its industry.

- Diversification Strategy: As with any investment portfolio, diversification is key. While investing in IPOs can be enticing, it’s important to maintain a well-balanced portfolio to mitigate risks. Consider how IPO investments align with your overall investment strategy.

- Stay Informed About Market Trends: Keep a watchful eye on market trends and investor sentiment. Changes in market conditions can impact the performance of IPOs. Stay informed through financial news, industry reports, and expert analyses.

Investing in IPOs is a venture that demands a combination of courage, strategic thinking, and due diligence. It opens doors to the potential for substantial returns, but success requires a thoughtful approach. As you navigate the world of IPOs, remember that each investment is a step into the future of a company—and, potentially, your own financial future.

12. Peer-to-Peer Lending

In the landscape of traditional finance, a disruptive force has emerged, reshaping the way individuals access and provide capital—welcome to the realm of Peer-to-Peer (P2P) Lending. This innovative financial model enables direct connections between lenders and borrowers, bypassing the conventional banking intermediaries. Peer-to-Peer Lending not only offers a novel avenue for securing loans but also provides an opportunity for investors to diversify their portfolios by becoming lenders themselves.

Key Points to Consider:

- Definition of P2P Lending: At its core, P2P Lending is a decentralized lending and borrowing platform that connects individuals looking for loans with those willing to lend money. The entire process unfolds online, eliminating the need for traditional financial institutions.

- Direct Connection: P2P Lending fosters a direct connection between borrowers and lenders. Borrowers can access funds with potentially lower interest rates than traditional loans, while lenders have the chance to earn interest on their funds, cutting out the middleman and promoting a more personal financial ecosystem.

- Diverse Borrowing Needs: The P2P landscape caters to a wide array of borrowing needs. Whether it’s personal loans, small business financing, or specific projects, borrowers can find funding tailored to their requirements. This flexibility contributes to the popularity of P2P platforms.

- Risk and Returns: While P2P Lending offers the potential for attractive returns, it’s not without risks. Lenders face the possibility of borrowers defaulting on loans. Diversification and thorough borrower assessment are crucial risk mitigation strategies for investors.

- Online Platforms: P2P lending operates through online platforms that act as intermediaries, facilitating the lending process. These platforms often use algorithms to assess the creditworthiness of borrowers and determine interest rates, creating a streamlined and efficient lending experience.

- Accessibility and Inclusivity: P2P Lending democratizes access to capital, providing an inclusive platform for both borrowers and lenders. Individuals who may face challenges obtaining loans through traditional channels can find opportunities within the P2P ecosystem.

- Regulatory Landscape: The regulatory environment for P2P lending varies across regions. Before engaging in P2P lending, it’s crucial to understand the regulatory framework in your jurisdiction. Compliance with regulations ensures a secure and transparent lending environment.

As the financial landscape continues to evolve, Peer-to-Peer Lending stands out as a testament to the power of decentralized financial models. Whether you’re seeking a loan or exploring new investment avenues, P2P Lending offers a dynamic platform that transcends the boundaries of traditional finance, fostering direct connections and financial empowerment.

13. Retail Arbitrage

In the ever-evolving landscape of commerce, savvy entrepreneurs have discovered a unique avenue for turning routine shopping into a lucrative venture—enter the world of Retail Arbitrage. This entrepreneurial strategy involves finding and capitalizing on price differentials between products in traditional retail stores and online marketplaces, creating opportunities for profit through strategic buying and selling.

Key Points to Consider:

- Definition of Retail Arbitrage: At its essence, Retail Arbitrage is the practice of purchasing products at a lower price in traditional retail settings, such as brick-and-mortar stores, and reselling them at a higher price, often through online platforms. This strategy exploits price variations to generate profit.

- Scouting for Deals: Successful Retail Arbitrage begins with a keen eye for spotting underpriced items. Arbitrageurs scour retail shelves, clearance sections, and discount stores in search of products with the potential for resale at a higher price.

- Utilizing Online Marketplaces: The power of Retail Arbitrage is amplified by the reach of online marketplaces. Platforms like Amazon, eBay, and others provide a vast audience for reselling products. Arbitrageurs leverage these platforms to reach a global market.

- Product Research: In-depth product research is a cornerstone of Retail Arbitrage. Analyzing market trends, demand patterns, and potential profit margins helps arbitrageurs make informed purchasing decisions. Mobile apps and online tools can assist in real-time product valuation.

- Strategic Sourcing: Identifying the right sourcing locations is crucial. Whether it’s clearance sales, seasonal discounts, or closeout deals, strategic sourcing ensures a steady supply of products with profit potential.

- Consideration of Fees and Costs: Successful Retail Arbitrage involves more than just buying low and selling high. Arbitrageurs must account for various fees, such as shipping, storage, and platform fees when determining their overall profit margin.

- Adaptability and Flexibility: The retail landscape is dynamic, with prices and demand fluctuating. Successful arbitrageurs stay adaptable, adjusting their strategies based on market changes, seasonality, and emerging trends.

- Compliance and Ethics: While Retail Arbitrage offers exciting opportunities, it’s important to operate ethically and comply with marketplace rules. Transparency and honesty contribute to a sustainable and reputable arbitrage business.

As a fusion of entrepreneurship and strategic acumen, Retail Arbitrage empowers individuals to transform everyday shopping into a profitable enterprise. The ability to uncover hidden gems on retail shelves and connect them with eager buyers in the digital marketplace is a testament to the innovation and creativity driving the modern entrepreneurial landscape.

14. Start an Etsy Store

In the vibrant realm of online marketplaces, where creativity meets commerce, Etsy stands as a beacon for artisans, crafters, and creative minds seeking a platform to showcase their unique creations. If you have a passion for crafting, a penchant for the handmade, and a desire to turn your creative endeavors into a thriving business, then starting an Etsy store could be your ticket to entrepreneurial success.

Key Points to Consider:

- Etsy’s Unique Marketplace: Etsy has carved a niche for itself as a global marketplace catering to those seeking one-of-a-kind, handmade, and vintage items. With millions of buyers exploring its virtual aisles, Etsy provides a fertile ground for creative entrepreneurs to connect with a diverse and appreciative audience.

- Crafting Your Unique Brand: Your Etsy store is more than just an online shop; it’s a representation of your artistic vision. From handmade jewelry to personalized home decor, Etsy allows you to craft and curate a unique brand that tells your story and resonates with customers who appreciate the artistry behind each creation.

- Accessible Platform for All: One of Etsy’s strengths lies in its accessibility. Whether you’re an experienced artisan or a hobbyist exploring your craft, Etsy provides a level playing field for sellers of all backgrounds. The platform encourages diversity and welcomes a wide range of creative expressions.

- Community and Support: Beyond being a marketplace, Etsy is a vibrant community. Sellers support each other through forums, discussions, and shared experiences. The sense of community fosters collaboration, inspiration, and a collective journey towards success.

- Ease of Setup and Management: Setting up an Etsy store is a straightforward process. The platform provides user-friendly tools and resources to help you showcase your products effectively. From listing items to managing orders, Etsy streamlines the administrative aspects, allowing you to focus on what you do best—creating.

- Global Reach: Etsy’s reach extends far beyond local markets. With a global customer base, your creations have the potential to find homes in various corners of the world. Etsy’s international presence opens doors to diverse cultures and markets eager to embrace unique, handmade treasures.

- Adapting to Trends: Etsy is not static; it evolves with the times. Stay attuned to market trends, seasonal demands, and customer preferences. Adapting to changing dynamics ensures that your Etsy store remains relevant and appealing to your target audience.

Embarking on the journey of starting an Etsy store is not just about selling products; it’s about sharing your passion with the world. As you set up shop in this digital marketplace, remember that each creation is a brushstroke in the canvas of your entrepreneurial adventure.

15. Invest in Small Businesses

In the vast landscape of investment opportunities, few endeavors carry the potential for both financial gain and community impact quite like investing in small businesses. Beyond the towering giants of industry, small businesses embody the spirit of entrepreneurship, resilience, and the pursuit of dreams. As an investor, channeling your resources into these burgeoning enterprises not only opens doors to potential returns but also plays a vital role in fostering economic growth and innovation.

Key Points to Consider:

- Backbone of Innovation: Small businesses are often the birthplace of innovation. From local artisanal endeavors to tech startups, these enterprises drive creativity, adaptability, and a spirit of experimentation that can lead to groundbreaking developments in various industries.

- Community Empowerment: Investing in small businesses is a direct investment in communities. Local establishments contribute to the vibrancy of neighborhoods, create job opportunities, and form the fabric of a community’s identity. By supporting small businesses, investors play a pivotal role in community empowerment.

- Diverse Investment Opportunities: Small businesses span a myriad of industries, offering investors a diverse range of opportunities. Whether it’s a boutique bakery, a tech startup, or a family-owned manufacturing venture, the small business landscape allows investors to align their portfolios with their passions and values.

- Personal Connection: Unlike investing in large corporations, investing in small businesses often involves a more personal connection. Investors can engage directly with entrepreneurs, understand their vision, and witness the tangible impact of their investment on the growth and development of the business.

- Flexibility and Adaptability: Small businesses are known for their agility. They can pivot quickly, adapt to market changes, and seize emerging opportunities. This flexibility positions them to navigate challenges effectively, making them attractive investment options in dynamic economic environments.

- Long-Term Relationship Building: Investing in small businesses isn’t just about a financial transaction—it’s about building relationships. Establishing a supportive connection with entrepreneurs fosters a sense of partnership and shared success, creating a win-win scenario for both parties involved.

- Mitigating Concentration Risk: Diversifying an investment portfolio is a fundamental strategy for risk management. By including small businesses in the investment mix, investors can mitigate concentration risk and enhance the resilience of their overall portfolio.

As you consider the prospect of investing in small businesses, remember that your investment has the power to spark growth, drive innovation, and contribute to the fabric of local economies. It’s not just about financial returns; it’s about being part of a journey that transforms dreams into reality and small ventures into thriving enterprises.

Tips for Turning 10k Into 100k

Embarking on the path of turning $10,000 into $100,000 is a financial venture that demands a combination of foresight, calculated risk, and disciplined decision-making. While there are no guarantees in the world of investments, certain strategies can enhance your chances of multiplying your initial capital. Here are some tips to guide you on this ambitious financial journey:

1. Diversify Your Investments:

- Spread your capital across different asset classes, such as stocks, bonds, real estate, and perhaps even alternative investments. Diversification helps mitigate risk by reducing the impact of poor performance in any single investment.

2. Educate Yourself:

- Knowledge is your most valuable asset. Take the time to educate yourself about various investment options, market trends, and financial instruments. Understanding the landscape will empower you to make informed and strategic decisions.

3. Consider High-Growth Stocks:

- While high-growth stocks come with higher risk, they also offer the potential for substantial returns. Identify companies with strong growth prospects, innovative products or services, and a track record of success.

4. Explore Real Estate Opportunities:

- Real estate can be a powerful wealth-building tool. Consider investing in properties with growth potential, or explore real estate investment trusts (REITs) for a more diversified approach to real estate investment.

5. Invest in Yourself:

- Consider using a portion of your capital to enhance your skills and knowledge. Investing in education, certifications, or starting a side business can increase your earning potential over the long term.

6. Set Clear Financial Goals:

- Define your financial goals and timelines. Having a clear roadmap will help you stay focused and disciplined in your approach. Whether it’s short-term gains or long-term wealth, align your investment strategy with your objectives.

7. Take Advantage of Tax-Efficient Strategies:

- Explore tax-efficient investment strategies to maximize your returns. Utilize tax-advantaged accounts, such as IRAs or 401(k)s, and be mindful of the tax implications of your investment decisions.

8. Embrace Compounding:

- Compound interest is a powerful force. Reinvest your earnings to allow your capital to grow exponentially over time. The longer your money compounds, the greater the potential for substantial returns.

9. Monitor and Adjust:

- Regularly review and adjust your investment portfolio based on changing market conditions, your financial goals, and risk tolerance. Being proactive and adaptable is crucial in the dynamic world of investing.

**10. Stay Disciplined and Patient: – Turning $10,000 into $100,000 is not an overnight journey. It requires discipline, patience, and the ability to weather market fluctuations. Stay focused on your long-term goals and avoid succumbing to impulsive decisions based on short-term market movements.

Remember, there’s always an inherent level of risk in investing, and past performance is not indicative of future results. It’s advisable to consult with financial professionals and conduct thorough research before making any significant investment decisions. The journey from 10k to 100k is a marathon, not a sprint—approach it with diligence and a strategic mindset.

Conclusion

In the pursuit of turning $10K into $100K, the journey is as much about strategy as it is about mindset. While there are no foolproof guarantees in the dynamic world of finance, adopting a thoughtful approach can significantly enhance the likelihood of success.

As you navigate this financial endeavor, remember the importance of diversification, continual learning, and staying attuned to market trends. Embrace the power of compounding, set clear goals, and be patient—wealth accumulation is a journey that requires time and discipline.

FAQs:

Can I turn 10000 into 100000?

Sure thing! Turning $10,000 into $100,000 is no small feat, but it’s not impossible. The key lies in strategic investments. Diversifying your portfolio, staying informed about market trends, and having a bit of patience can go a long way. High-risk, high-reward options might be tempting, but they come with, well, high risk.

Consider a balanced approach, maybe a mix of stocks, bonds, and other investment vehicles. Remember, slow and steady wins the race, and financial growth often takes time. Always do your research and maybe consult with a financial advisor to make informed decisions.

How Can I Turn 10k Into 100k in a Month?

Turning $10,000 into $100,000 in a month is an incredibly ambitious goal and comes with exceptionally high risk. While there are high-risk trading strategies and speculative investments, it’s crucial to be aware that such rapid gains often involve a substantial potential for losses. Consider the adage “the higher the reward, the higher the risk.”

It’s advisable to approach this goal with caution, perhaps seeking professional financial advice and thoroughly researching any investment opportunities. Remember, quick riches usually come with quick risks.

What is a good way to invest 10K?

Investing $10,000 offers several options depending on your financial goals and risk tolerance. A diversified approach is often wise, considering a mix of stocks, bonds, and perhaps some in high-interest savings or low-cost index funds.

Research and understand different investment vehicles, and consider your timeline—short-term goals may lean towards safer options, while long-term goals could involve more risk for potential higher returns. If unsure, seeking advice from a financial advisor is a prudent step to tailor your investment strategy to your specific circumstances.

How can I double 10K?

Doubling $10,000 requires a careful and strategic approach. Consider investing in a mix of assets like stocks, bonds, or mutual funds. Diversifying your portfolio can help spread risk.

Research and choose investments based on your risk tolerance and financial goals. Keep a long-term perspective, as doubling your money quickly often involves higher risks. Patience and informed decision-making are key to achieving your goal.

How to Turn 10K into 20K Reddit?

On Reddit, you’ll find various discussions and suggestions on turning $10,000 into $20,000. Ideas may range from stock tips to entrepreneurial ventures. Remember to critically evaluate any advice, consider the risks, and do thorough research before making financial decisions.

Engaging in subreddit communities related to investing or personal finance can provide diverse perspectives, but always verify information independently. Each financial journey is unique, so tailor any advice to your specific situation and risk tolerance.

Hello, I’m Zubair Rabbani. I recently graduated and have now gained expertise in website content writing and SEO. The content featured in this blog will focus on topics related to SEO and strategies for making money online. Read More